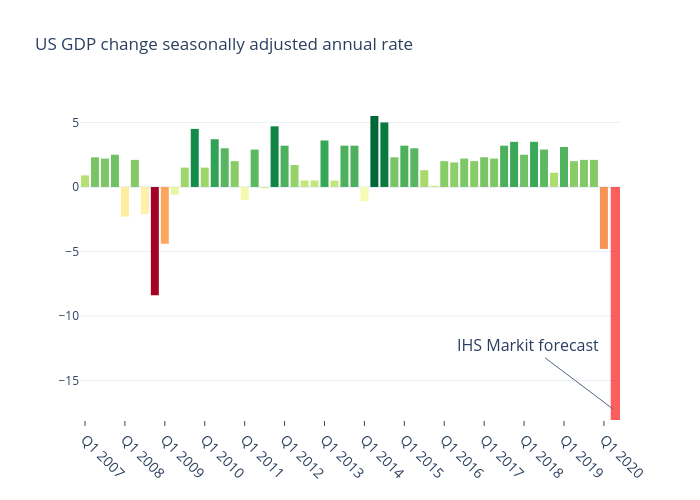

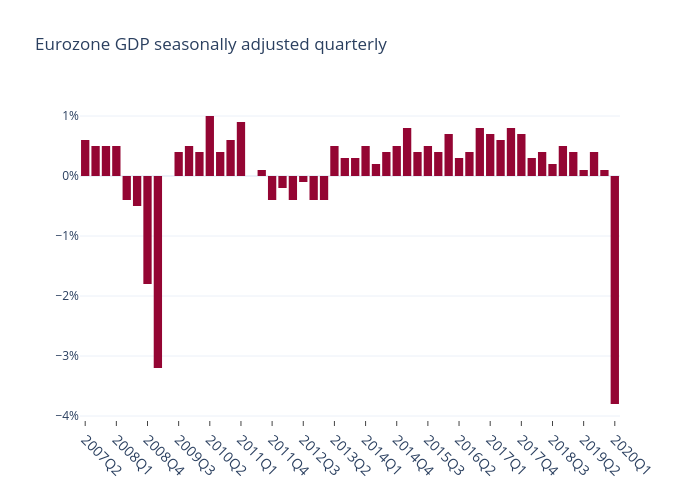

The IMF declared at the beginning of April that we have entered into “the worst economic downturn since the Great Depression”. Yesterday, their perspective was confirmed when figures released for the US showed a rate of 4.8 percent decline. Today, the figures are out showing a 3.8 percent contraction in one quarter in the Eurozone. The disastrous handling of the coronavirus pandemic sharpened an economic crisis that was already in the making.

An unprecedented fall

The figures released today were worse than expected. The 3.8 percent drop in the Eurozone for one quarter is significantly worse than the US 4.8 percent on an annualised basis (the equivalent figure for the US would be somewhere in the region of 1.5 percent). The French economy has contracted by 5.8 percent and the Spanish by 5.2 percent last quarter. The figures for the European economies are worse than any quarter on record and the drop is far more dire than in 2009. The second quarter is expected to be worse everywhere.

The virus epidemic couldn't have hit at a less opportune time. The world economy never recovered from the crisis of 2008-09, as we have explained in the past. What recovery there was had ebbed, with the economies of Germany, Japan and the UK at the very least already contracting.

Capitalism is facing a crisis of senile decay. This rotten system should have been overthrown a century ago, but a combination of world war, and the role of reformists and Stalinists gave it a new lease on life. The first signs of the end of the post-war boom could already be seen in the crisis of the ‘70s, but through austerity and attacks on the working class, combined with an unprecedented expansion of credit, the capitalist class postponed the evil day. Now, the chickens are coming home to roost.

The IMF World Economic Outlook earlier this month made for dire reading. The IMF forecasted a contraction of 4.2 percent in the world economy this year. That’s significantly worse than the previous post-war record fall in 2009 of 1.6 percent. The vast majority of countries would suffer a recession this year, with the advanced capitalist countries being hardest hit. The Eurozone would face a 7 percent contraction. Japan – at this point relatively unaffected by the epidemic – a 5 percent contraction, and the US a 6 percent contraction. All of these predictions assume the pandemic would be over sometime this summer, and there would be no second wave of the virus this year or next year. This is not an optimism that is shared by epidemiologists.

The IMF helpfully provides us with alternative scenarios of what would happen if their baseline prediction doesn’t hold up. If there is another wave in the second half of the year, the fall would be steeper, at around 7 percent. Yet, the IMF is on the optimistic side of the argument.

A number of private institutions are predicting more grim scenarios: IHS Markit was predicting a 3 percent fall in the US GDP Q1 2020, on an annualised basis. This turned out to be an optimistic estimate, as figures out on 29 April showed the equivalent of an 4.8 percent contraction (annualised). IHS Markit furthermore predicted an eye watering 27 percent drop in Q2 as the lockdown impact hits (again, on an annualised basis). This doesn’t mean literally a 27 percent drop this quarter, but that the rate of decline is such because the effects of the lockdown will not accumulate over coming quarters. Still, the drop is expected to be significantly more severe than in 2009. In other parts of the world, Morgan Stanley is predicting an 11 percent drop in Eurozone output this year, with the UK not far behind on 10 percent. Even Christine Lagarde was threatening Eurozone governments with a 15 percent drop in output if they didn’t take action.

Christine Lagarde warned of a 15 percent drop in output in the Eurozone unless governments take drastic action / Image: Brinacor

Christine Lagarde warned of a 15 percent drop in output in the Eurozone unless governments take drastic action / Image: Brinacor

Another curious assumption made by the IMF is that the infection won’t spread widely outside the advanced capitalist countries. Why the poorer countries of the world would be better equipped to deal with the pandemic is anyone’s guess. In these countries, starved of resources and bled dry by imperialism, overcrowding, poor housing and lack of healthcare will create the conditions for a human catastrophe. The only saving grace so far has been the relative lack of international travellers, which has reduced the number of imported cases, but once local transmission takes off there will be little stopping it.

As the infection spreads rapidly in India, Africa and Latin America, the prospect is raised also of an economic disaster: whereas the IMF expected India to grow by 2 percent in 2020, Fitch Ratings and Barclays Bank both predict stagnation, with 0.8 percent and 0 growth respectively.

But all of these forecasts are qualified guesswork. The truth is that no one really knows. The IMF also assumes that the economy will rebound quickly, as soon as measures are lifted, but that is also a big assumption.

Disaster in the making

Many industries are reeling from the crisis:

- Retail shops were already struggling under the pressure from online retailers. Many shops that have been closed now for the purpose of social distancing will never reopen, or if they do, they will find their customers are no longer there.

- The same goes for restaurants who, if they survive the lock-down, will not see their customers return.

- The travel industry will probably recover, but will not get anywhere close to what it was any time soon. At this moment in time, the worldwide airline capacity is down 73 percent. The airline industry took six to eight years to recover from the 9/11 attacks, and that was during a boom. This time will probably be worse. Both Airbus and Boeing are looking for bailouts.

- Higher education is going to be hit hard. This is the case in the two biggest markets for education: UK and US.

- The oil industry is in a panic mode. Demand for oil has fallen by 20 million barrels a day, or roughly 20 percent, as people are staying home. Even the unprecedented agreement between the US, Saudi Arabia and Russia has failed to raise the price above its 18-year low.

- The automotive industry, central to the manufacturing sector, is forecast to see a cut in sales by 21 percent globally, with a 26 percent drop in Europe. If it wasn’t for massive government support, this would have already resulted in mass layoffs and plant closures.

- Even US hospitals, in their own particular grim calculations, are asking for bailouts after having to cancel more profitable procedures in order to treat coronavirus patients.

Despite governments around the world paying unprecedented amounts in support to business, unemployment is rising at an unprecedented rate. In the US, 26 million have applied for unemployment benefits (which doesn’t necessarily mean they have been permanently laid off).

Economists surveyed by the Wall Street Journal expect 14 million jobs to be lost in the next couple of months and the unemployment rate to rise to 13 percent in June: the fastest increase ever. One of Trump’s economic advisors, Kevin Hasset, has made headlines by predicting a 16-17 percent unemployment rate, comparing this to the 2008-2009 crisis when the US lost 8.7 million jobs: “Right now, we're losing that many jobs about every 10 days”.

No one, of course, knows where this will end, but they are already raising the prospect of unemployment rising to 20 percent in the US and northern Europe, which managed to avoid mass unemployment in 2009. The ILO is warning that 1.6 billion people – half the global workforce – is “in immediate risk of losing livelihood”. It also estimates that 1.6 billion workers in the informal sector already have lost 60 percent of their earnings in the first month of the crisis.

The 1930s saw US GDP fall by 25 percent over a 3 year period, with unemployment rising to 25 percent. If the bourgeois managed to avoid a depression in 2008-9, now this prospect is very real:

“‘Severely depressed demand, supply disruptions and extremely high uncertainty will keep manufacturing on an extremely weak trajectory in the near term,’ said Oren Klachkin, economist at Oxford Economics. ‘We believe the economy will gradually start to return to normal in Q3, we note that the risk of an extended lockdown could make for a very slow and uneven recovery.’”

The hope of the economists is that the economy will be able to recover rapidly once the artificial constraints are removed. Yet, the longer they remain in place, the more damage they will cause. The capitalist market economy is by far the least suited to these kinds of measures. The famous invisible hand is highly dependent on credit and confidence, the latter being a prerequisite of the former. Yet, at the moment, there is no confidence in the future.

Consumers and businesses look to the future with trepidation, as no one knows what is around the corner. No one knows what the world will look like after lockdown ends (not to mention when it will end), and so no one will make the investments that are needed in order to kickstart the economy again. Why invest in productive capacity when the productive capacity is already too plentiful and you don’t know whether the customers will want your products or be able to afford them?

A lender of last resort

This is why the state is now playing an unprecedented role. The state is now the lender of last resort, the consumer of last resort and the goose that lays the golden eggs. We commented on this in an article published a month ago, but now developments have gone even further.

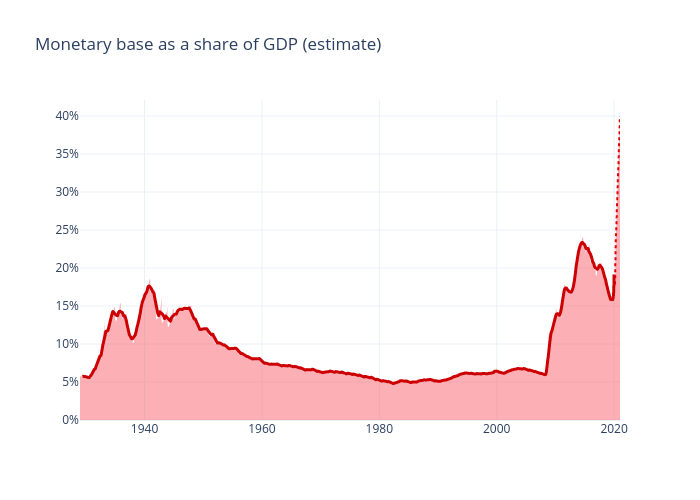

State debts were already high, if not as high as during World War II. Now, they are set to overtake their world war peak, with no realistic prospect of being paid back. The state has pledged unprecedented amounts of money in loans and subsidies in an attempt to keep business open during the lockdown.

Market after market is failing. The insecurity and the lack of credit (despite all their best efforts) mean that companies that were reasonably sound three months ago are now facing bankruptcy. In the world of finance, always fond of making up new buzzwords, this has become known as a “fallen angel”. Now, governments and central banks are expected to keep these companies alive until the situation stabilises.

In the US, the Federal Reserve is massively expanding its balance sheet as it pushes credit into markets where it hasn’t been present since the Great Depression. A $600 billion programme is taking shape, offering loans through banks of up to four years to small and mid-size businesses. It’s trying to insulate itself from the losses, asking the issuing banks to take 5 percent of the loans and the federal government to cover the first $75 billion of any potential losses from the scheme.

However, the small and mid-size business lending is dwarfed by the total credit being pumped into the system. At the end of last year, the Federal Reserve had around $4 trillion on its balance sheet. But it is now seeing an extremely rapid programme of asset purchases (how central banks lend money). By 22 April, it had reached $6.6 trillion, and it is expected to reach $8-11 trillion. At the height of the depression of the 1930s, the balance sheet of the Fed was just above 20 percent of US GDP. It surpassed that level in about 2011. Now, they’re expecting it to reach 40-50 percent – and in record time.

The ECB is widely expected to start supporting “fallen angel” junk bonds this week in order to prevent large-scale bankruptcies in the Eurozone. They are also expected to further expand their €2.8 trillion quantitative easing programme. Despite the ECB not yet formally having agreed to do so, markets and rating agencies are firmly expecting it to prevent both companies and southern European countries going bankrupt. In reality, they are giving the ECB little choice in the matter.

...and a spender of last resort

Government debts worldwide are estimated to rise by 16 points of national income, from 69 to 85 percent of GDP this year. The US budget deficit is estimated at 19 percent (the highest since 1945) after the fourth pandemic relief package, and will only get bigger. The average for the advanced capitalist economies is just over 10 percent, and Brazil, China and India are at a similar level. Thus, not only is the state effectively guaranteeing a large chunk of the debt market but a large chunk of the expenditure in the economy is made up by the deficit in the state budget.

At the same time as attempting to bring down companies’ borrowing costs, governments are also shuffling large-scale subsidies to companies to keep employees on the books. More than 30 million workers in Germany, France, the UK, Italy and Spain are having the state pay their salaries, albeit at a reduced rate. This is around one fifth of the entire workforce of these countries.

One of the problems with these schemes, which are intended to provide short-term support to otherwise viable companies, is that it is virtually impossible to know what will be a viable business or not in five months' time, as the past is not a very good guide to the future. The risk is clear that central banks and governments will wind up keeping companies on life support with no end in sight.

This is precisely what the government and central banks are not supposed to be doing, but they have no alternative:

“‘Capitalism without bankruptcy is like Catholicism without hell,’ Howard Marks, director of investment fund Oaktree Capital Management LP, said in a letter to shareholders this month, writing that ‘Markets work best when participants have a healthy fear of loss.’ Mr. Marks in a later interview said he didn’t want to imply Mr. Powell’s actions were wrong: ‘The fact that something can have negative, unintended consequences, doesn’t mean it’s a mistake.’”

Whatever they might think of the measures, very few actually think they are wrong, and fewer still have any alternative. Republicans who were objecting to the bailouts of 2008 are now supporting the measures with the excuse that circumstances are unique: “This should be considered a very freakish Black Swan event, not anything that would be revisited under ordinary circumstances,” according to Senator Pat Toomey. Steve Bannon, Trump’s one time political advisor is just one of many to recognise the new situation:

“‘The era of Robert Taft, limited-government conservatism?’ said Steve Bannon, President Trump’s onetime political guru, referring to the Ohio senator who fought the expansion of government programs and federal borrowing. ‘It’s not relevant. It’s just not relevant.’”

Even the Brazilian “Chicago Boy” finance minister, Guedes, has been forced to relent under pressure from the ruling class. The ruling class are not interested in empty platitudes and are openly discussing whether he is up to the job or should be sacked. He has introduced a $223 billion emergency support package, and is now trying to defend himself from looking “like a Keynesian economist”. Apparently he has drawn a “conceptual distinction” between emergency measures and structural reform. But Keynes was never a principled proponent of state intervention, he merely saw it as a necessity under certain circumstances to ensure the functioning of capitalism and prevent revolution.

To give Guedes and Toomey their due, it is true that crises of this magnitude only occur very rarely, like a black swan. In fact it’s only the second one in the history of capitalism. However, that caveat is meaningless, given that we are in a crisis right now and there is no way out in the short term. It only reinforces the point that faced with this crisis they are only capable of throwing lots of public money at the problem. It doesn’t matter if they are followers of Friedman or Keynes. They wound up doing the same thing in the end, because they have no choice.

The role of the state

The increased role of the state in itself is itself a symptom of the rebellion of the productive forces against the constraints of private property, as Engels, Lenin and Trotsky pointed out. Ted Grant explained this in the 1950s:

“Of course the increased role of the state with the end of laissez faire had already been pointed out by Marx and Engels. The tendency of the productive forces to outgrow the envelope of private ownership, forces the state to intervene more and more in the 'regulation' of the economy.”

And again how the monetarist trend of the past few decades will necessarily have to be thrown into reverse:

“‘Every action has an equal and opposite reaction.’ This law applies not only to physics but to society. The drive towards privatisation will reach its limits. This is already beginning to happen in Britain. At a certain stage, the tendency towards statisation will reassert itself.”

This is what has now happened, and with a bang. It does, however, in no way solve the crisis, but merely provides a band-aid by transferring the liabilities onto the public balance sheet. In the 1950s, there were plenty of illusions that state intervention would solve the problems of capitalism. Ted Grant pointed out that it would not stop another crisis, and he was proven correct when the boom of the 1950s gave way to the crisis of the 1970s.

This virus has hit an economy that was already struggling hard. This crisis has been in preparation since the end of World War II. The capitalists managed to postpone it by a massive increase in debt, but that has now reached its limits. The crisis of overproduction is in full swing.

Some large corporations will emerge out of this stronger. They will do so not on the basis of developing the productive forces, by investing in new technology and industry, but my means of being the last company standing, as the other, less profitable, go bankrupt. Consolidation will inevitably mean job losses. This will further undercut the market, which will make new investments unprofitable. The state will intervene to save the companies that are too big to fail, but it can not save the economy as a whole.

State monopoly capitalism, as Lenin called it, doesn’t stop the crises of capitalism because it doesn’t actually do away with the anarchy of the market. The profit motive remains the driving force of the economy, it is just given a helping hand by the state. Yet, whatever lines of credit are extended to the multinational companies, whatever subsidies, there will be no investment unless there is a market, and the market now is shrinking, as workers are laid off and taking pay cuts.

A planned economy is needed

The coming disaster is not a necessity. If we didn’t live under this barbaric society, which puts profits above all else, we would be able to manage the crisis without it turning into a catastrophe. If too many products are produced, that should merely give workers additional spare time. Only under the warped logic of capitalism does too much productive capacity turn into a crisis.

Capitalism is preparing misery for billions of workers / Image: Pixabay

Capitalism is preparing misery for billions of workers / Image: Pixabay

A nationalised planned economy could, in these circumstances, shut down with little damage to the long-term prospects of the economy. There would of course be some dislocation but the economy would be able to restart at a similar level of production. There might be some shortages of less-essential items for a period, but there would be no unemployment, no starvation, no homelessnes and the economy would recover quickly.

Resources could be allocated rapidly from one sector of the economy to another, using the ingenuity of the working class, fully involved in the management of the economy. There would be no need to pay capitalists extortionate sums of money in order to get them to fulfill the basic needs of society, whether it’s food or protective equipment. The level of solidarity between workers is on display everywhere the virus has hit. If workers were in charge, rather than excluded from all the important decisions, the spontaneous outpouring of solidarity on social media and clapping in the streets would have been transformed into concrete action.

Capitalism is preparing misery for billions of workers. Our task is to confine this rotten system to the dustbin of history where it belongs. The future of humanity depends on it.